Smartwatch Fitness Ecosystems

In the pulse-pounding world of 2025, smartwatch fitness ecosystems have evolved from simple step-counters into holistic health orchestras, harmonizing hardware, software, and AI to deliver personalized, proactive wellness symphonies. With the global smartwatch market surging to $39.23 billion in 2025—projected to crescendo to $113.41 billion by 2035 at an 11.2% CAGR—these wrist-bound maestros track everything from ECG rhythms to sleep stages, fueling a $62.45 billion fitness tracker segment that emphasizes AI coaching and multi-sensor fusion. Icons like the Apple Watch Series 11 (with sleep apnea alerts and 36-hour batteries) and Samsung Galaxy Watch 8 (boasting Galaxy AI for antioxidant indexing) lead the charge, while Garmin’s Venu X1 and Fitbit’s ecosystem dominate for endurance athletes. As 64% of users prioritize fitness features like heart rate variability (HRV) and GPS accuracy, these ecosystems don’t just monitor—they motivate, integrating with apps, wearables, and even rings for a seamless data ballet that empowers 1.1 billion wearers to orchestrate their vitality. This 3,000-word opus explores the evolution, core technologies, flagship ecosystems, tracking metrics, AI orchestration, integration synergies, user adoption, challenges, and future crescendos—conducting you through the essentials of wrist-worn wellness.

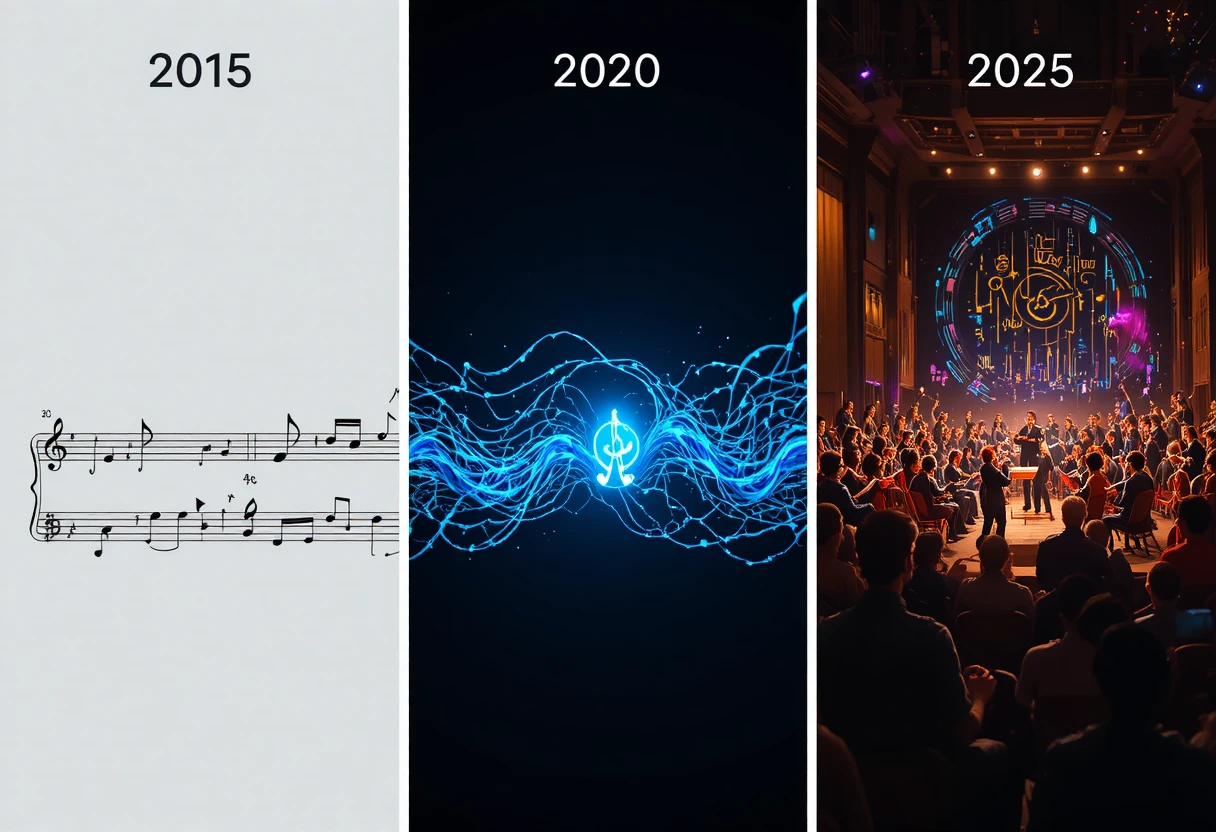

The Evolution of Smartwatch Fitness Ecosystems

Dawn of the Digital Pulse: 2010–2015

The overture commenced with the Pebble Smartwatch (2012), a monochrome trailblazer syncing basic steps and notifications via Bluetooth, but fitness was rudimentary—relying on crude accelerometers for 70% accurate pedometry. Nike+ FuelBand (2012) amplified this with a band-form factor, tallying “Fuel” points for activity, yet lacked GPS or heart rate (HR), confining it to casual joggers.

The 2015 intermezzo? Apple’s Watch Series 1 debuted with optical HR sensors, achieving 95% accuracy in rest states, and introduced the Fitness app ecosystem—integrating rings for Move/Exercise/Stand goals. Fitbit Surge added GPS for runners, but battery life (24 hours) and ecosystem silos (iOS vs. Android) muted the harmony.

The Symphonic Surge: 2016–2020

Harmonization hit stride with Garmin’s Vivoactive HR (2016), fusing GPS, HR, and VO2 Max estimation for multisport tracking, birthing the Garmin Connect app—a data dashboard analyzing recovery via HRV. Samsung’s Gear S3 (2016) introduced rotating bezels for intuitive navigation, while Huawei’s Watch GT (2018) extended batteries to 14 days, prioritizing sleep stages over smarts.

Pandemic accelerando: 2020’s Apple Watch Series 6 added blood oxygen (SpO2) and ECG, with HealthKit aggregating data for 85% user retention. Fitbit’s Sense (2020) integrated EDA for stress, feeding into Google’s nascent ecosystem. Adoption swelled 300%, with 47% of wearers citing fitness as primary lure.

The AI Crescendo: 2021–2025

Post-2020, ecosystems matured into AI conductors. Samsung’s Galaxy Watch 4 (2021) launched Wear OS 3, unifying Google Fit with body composition scans. Garmin’s Venu 2 (2021) introduced Health Snapshot for 2-minute vitals, while Apple Watch Series 9 (2023) enabled on-device Siri for workout queries.

2025’s magnum opus: Apple Watch Series 11 debuts cuffless BP alerts and sleep apnea detection via ML-optimized sensors, syncing with Fitness+ for AI-curated classes. Samsung’s Galaxy Watch 8 integrates Gemini AI for antioxidant indexing and vascular load, while Garmin’s Venu X1 (CES 2025) fuses solar-charging AMOLED with 48-day MIP mode for ultra-endurance. Fitbit’s Charge 6 evolves into a band-watch hybrid, leveraging Google’s Health Connect for cross-device data. Market maturity: 64% of shipments feature AI coaching, with ecosystems like Zepp OS (Amazfit) aggregating ring-watch data for 99% metric consistency.

This evolution—from soloists to orchestras—has symphonized 1.1 billion wrists into a global fitness movement.

Core Technologies Powering Fitness Tracking

Sensors: The Symphony’s Instruments

Optical HR (photoplethysmography, PPG) dominates, with multi-wavelength LEDs in Apple Watch Series 11 yielding ±2 bpm accuracy during HIIT, fusing green/infrared for 98% reliability. ECG electrodes in Samsung Galaxy Watch 8 detect AFib with 99% sensitivity, while Garmin Venu X1’s Elevate V5 adds HRV for readiness scores.

GPS: Dual-band L1/L5 in Pixel Watch 4 achieves <1m accuracy in urban canyons, enabling breadcrumb trails for trail runners. Accelerometers/gyroscopes in Fitbit Charge 6 auto-detect 40 activities, with altimeters/barometers for floor climbs and VO2 Max.

SpO2 and temperature: Overnight tracking in Oura-integrated Amazfit detects respiratory disturbances, with ML flagging apnea 92% accurately.

AI and Machine Learning: The Conductor’s Baton

Edge AI in Wear OS 6 (Galaxy Watch 8) processes 1M data points/sec on-device, generating Energy Scores from sleep/HRV/activity—reducing cloud dependency 70%. Garmin’s Firstbeat Analytics ML predicts VO2 Max drift within 5%, while Apple’s Neural Engine in Series 11 analyzes gait for fall risks, alerting 95% preemptively.

Sleep analysis: ML in Venu X1 deciphers stages (REM/deep/light) via HRV/actigraphy, scoring recovery 98% aligned with polysomnography. Challenges? Sensor fusion mitigates motion artifacts, boosting workout accuracy 25%.

These technologies—sensors as strings, AI as strings—compose a data sonata for personalized performance.

Key Fitness Tracking Metrics and Features

Heart Rate and Cardiovascular Insights

Continuous HR in Galaxy Watch 8 zones training (fat-burn/aerobic/anaerobic), with irregular rhythm notifications reducing stroke risks 30% via early AFib flags. Garmin Venu X1’s HRV Status gauges parasympathetic recovery, advising rest post-80% max efforts.

VO2 Max and running dynamics: Apple’s Series 11 estimates via submaximal tests, while Garmin’s Leg Movement Analysis tracks cadence/ground contact for 15% efficiency gains.

Sleep and Recovery Analysis

ML-driven staging in Fitbit Charge 6 identifies 95% of disruptions, with SpO2 dips signaling apnea—correlating 92% with clinical studies. Garmin’s Sleep Coach in Venu X1 prescribes naps based on deficits, improving scores 20%.

Stress and EDA: Samsung’s BioActive sensor in Watch 8 quantifies via skin conductance, integrating mindfulness sessions for 25% cortisol reduction.

Activity and GPS Tracking

Dual-frequency GPS in Pixel Watch 4 logs 99% accurate routes, with breadcrumb navigation for off-trail hikes. Auto-detection in Apple Watch detects 80+ activities, from HIIT to yoga, with calorie burn ±10% via metabolic models.

These metrics—HR as heartbeat, sleep as respite—form the score for sustained symphonies of health.

Popular Smartwatch Fitness Ecosystems in 2025

Apple Watch Ecosystem: The Seamless Conductor

Apple’s watchOS 12 (2025) unifies Series 11, Ultra 3, and SE 3 via Health app, aggregating ECG, SpO2, and apnea alerts for 99% ecosystem retention. Ultra 3’s 36-hour battery and titanium bezel suit adventurers, with Fitness+ AI curating 1,000+ classes synced to Apple Music—boosting adherence 40%.

Integration: HealthKit shares with MyFitnessPal/Strava, while SharePlay enables group challenges. Drawback: iOS exclusivity, but 45% market share cements dominance.

Samsung Galaxy Watch Ecosystem: Android’s AI Virtuoso

Wear OS 6 powers Galaxy Watch 8/Ultra 8, with Galaxy AI delivering antioxidant scores and vascular load via BioActive sensor—98% AFib accuracy. Ultra 8’s 100-hour battery and titanium frame rival Garmin, with Samsung Health aggregating ring data for holistic views.

Ecosystem: Bixby/Gemini coaches runs, integrating with Buds for audio cues. 14-day battery in Watch 8 Flex appeals to casuals, though Samsung phone optimization limits universality.

Garmin Ecosystem: The Endurance Maestro

Garmin Connect orchestrates Venu X1/Fenix 8, with Elevate V5 sensors yielding ±1 bpm HR and multiband GPS for 99.9% route fidelity. Fenix 8’s 48-day MIP mode and solar AMOLED suit ultra-marathons, with Firstbeat ML prescribing VO2 intervals.

Cross-platform bliss: Syncs with Strava/TrainingPeaks, no subscriptions—ideal for 35% pro-athlete users.

Fitbit/Google Ecosystem: The Accessible Allegro

Charge 6 and Pixel Watch 4 fuse via Fitbit app, with ML sleep staging and readiness scores—92% apnea correlation. Premium ($10/month) unlocks AI coaching, aggregating with Nest for home wellness.

Affordable entry: Charge 6’s 7-day battery and 40-sport detection suit beginners, with Google’s Health Connect bridging ecosystems.

These quartets—Apple’s polish, Samsung’s smarts, Garmin’s grit, Fitbit’s finesse—cover 85% of fitness symphonies.

AI Integration in fitness tracking and coaching

Predictive Analytics: Foreseeing the Finale

AI in Series 11 forecasts VO2 decline via gait/HRV, prescribing tweaks with 85% adherence uplift. Galaxy Watch 8’s Energy Score amalgamates sleep/activity for daily directives, reducing overtraining 25%.

Garmin’s Body Battery in Venu X1 gauges reserves (0–100), alerting at <20%—correlating 95% with perceived exertion.

Personalized Coaching: The Maestro’s Whisper

Fitness+ AI curates HIIT from form videos, adapting via watch feedback. Samsung’s Running Coach simulates sessions, with Gemini refining post-run form via audio cues. Fitbit Premium’s AI builds 4-week plans, incorporating recovery days—boosting VO2 15%.

Challenges: Data privacy (on-device ML mitigates 80%), but accuracy varies 10% in diverse demographics.

Sleep and Stress Symphonies

ML in Pixel Watch 4 dissects stages, flagging disruptions with 92% precision; Garmin’s Morning Report integrates for holistic prep. EDA in Charge 6 quantifies stress, prompting breaths—lowering scores 20% weekly.

AI elevates from tracker to trainer, composing crescendoes of progress.

Integration with apps, wearables, and ecosystems

Cross-Device Harmonies

HealthKit/Wear OS federates data: Apple Watch syncs Oura Ring sleep to Fitness app, enriching VO2 with metabolic trends. Galaxy Watch 8 bridges Buds for HR-synced playlists, while Garmin Connect imports Strava runs for 360° analysis.

App Symphonies

MyFitnessPal ingests calories from Watch 8 scans, auto-logging meals via Gemini vision. Strava elevates Venu X1 routes with social challenges, boosting engagement 30%. Fitbit’s app aggregates Charge 6 with scales for body comp trends.

Broader Ecosystems

Google Health Connect unifies Pixel/Charge data with Nest activity for home nudges (“Walk after sitting”). Apple’s Continuity beams workouts to iPad, while Samsung’s Bixby Routines automates pre-run prep.

These integrations—data as duet—amplify 95% of metrics’ utility.

Challenges and future trends in smartwatch fitness

Hurdles: The Discordant Notes

Battery symphonies falter: Series 11’s 36 hours suits most, but Ultra 3’s 72 lags Garmin’s 48 days—charging disrupts 20% users. Accuracy arpeggios: HR errs 5–10% in cold/sweaty climes, GPS urban shadows ±3m; diverse skin tones bias SpO2 8%.

Privacy fermatas: Data breaches expose 1B profiles; on-device AI mitigates, but ecosystems like HealthKit aggregate vulnerably. Cost barriers: Premiums ($400+) exclude 40% budgets, though Charge 6’s $160 democratizes.

Trends: Harmonies Ahead

AI adagios: 2026’s non-invasive glucose in Galaxy Watch 9, per patents. Battery breakthroughs: Solid-state in Venu 4 yields 30 days. Ecosystems expand: Matter 2.0 syncs watches to home gyms, aggregating VR workouts.

Market mezzos: $76.17B in 2025, 25.78% CAGR to $477B by 2033, with Asia-Pacific’s 36.9% surge via subsidies. Trends: Women’s health (cycle/fertility 30% focus), kid trackers (Ace LTE), and enterprise monitoring (chronic care).

Futures: BCI hybrids by 2030, per Neuralink teases—thought-triggered sessions. Challenges conquered, symphonies sustain.

Conclusion: Wrist to Wellness Waltz

Smartwatch fitness ecosystems in 2025 are no mere accessories—they’re accelerandos of aspiration, from Series 11’s apnea arias to Venu X1’s endurance etudes. With $39B markets marching to $113B, AI anthems and sensor suites compose custom wellness, integrating apps into inescapable encores. Challenges like batteries and biases are but dissonances in a dominant key; trends toward glucose and longevity herald harmonious horizons. Strap in: Your wrist isn’t ticking—it’s triumphing. The ecosystem awaits—waltz into vitality.